Credit Rating in the Classification Certificate in the Kingdom of Saudi Arabia

The classification system in the Kingdom of Saudi Arabia is a fundamental tool launched by the Ministry of Municipal and Rural Affairs and Housing to regulate and develop the service sector and enhance the efficiency of city service providers. The system relies on the classification of establishments and their specializations according to precise criteria encompassing financial, technical, administrative, and executive aspects. This system is considered a key measure for determining establishments’ capabilities and their ability to meet service delivery requirements with efficiency and high quality, contributing to enhancing transparency and reliability for beneficiaries.

Credit Rating (Financial Criteria):

A credit rating is one of the basic requirements for obtaining a rating certificate in the Kingdom. It relies on a set of financial criteria that analyze a company’s figures and activities to produce a credit rating that reflects the company’s financial condition and stability. Financial criteria are the criteria used to obtain a company’s credit rating. The credit rating is based on an assessment of the company’s financial capabilities and its ability to meet its financial obligations and repay its debts on time. It also determines the company’s degree of financial risk and its ability to manage working capital in projects.

A company’s credit rating is based on four main elements:

-The financial position of the company

-The level of governance in the company

-Comparing the company’s position to its peers in the market

-The total number, type, and value of projects implemented by the company

The financial status of the facility:

It includes the company’s financial performance and financial statements, including the company’s assets, profits, and cash flow. The entity’s credit rating is assessed according to a set of criteria, the most important of which are:

-Liquidity Analysis

-Financial Leverage Analysis

-Gross Profit Analysis

-Profit Margin Analysis

-Asset Turnover Analysis

-Cash Cycle Analysis

-Debt and Financial Arrears Analysis

Governance ratio:

Here, the duration of implementation of governance procedures within the company is measured. This includes the presence of clear risk management mechanisms and quality and performance evaluation mechanisms within the organization. The evaluation is based on three main points:

-Administrative governance

-Risk management mechanism

-Publishing periodic performance reports

Comparing the facility’s position with its counterparts in the market

The facility’s position is compared to similar companies in terms of size and activity to assess its creditworthiness. This includes focusing on:

-The facility’s sources of income

-Fixed and variable assets

-Technologies used to monitor projects

Equipment

Total number, type and value of projects

This is the total number and value of projects implemented by the contractor or currently being implemented inside or outside the Kingdom, provided that the project completion rate is no less than 50% for implementation projects and 30% for maintenance, operation, and services projects.

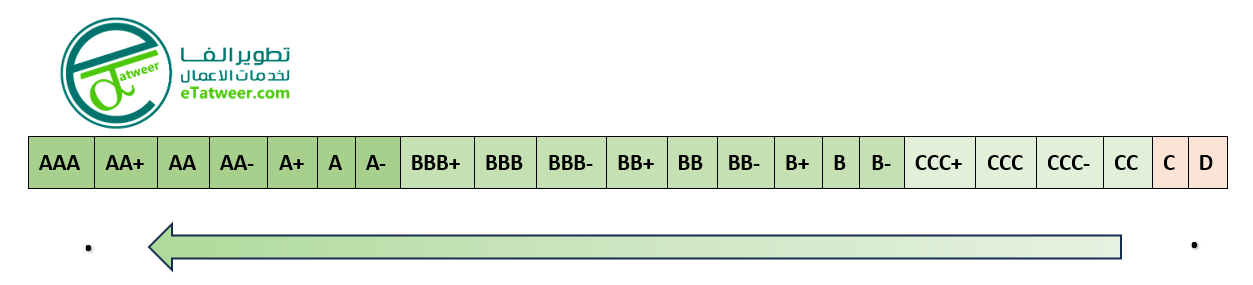

The credit rating is a basic requirement for an establishment to obtain a classification certificate from the Ministry of Municipal and Rural Affairs and Housing. The credit rating is expressed using letters with a sign to indicate the establishment’s credit rating, ranging from AAA to D, as will be explained in the credit rating table.

Credit Scores:

After the facility’s credit assessment is completed, the facility receives a credit score based on its compliance with the aforementioned criteria. Credit scores range from D (the lowest) to AAA (the highest).

Credit Scores Table:

Note:

For an establishment to obtain a classification certificate, its credit rating must be CC or above. A D or C rating will not allow it to be obtained.

Rating paths to obtaining an entity’s credit rating:

The rating process in Saudi Arabia follows several approved paths for providing credit assessments to entities seeking a rating. The assessment procedures are carried out according to the following paths:

Regular Path: The credit assessment service is provided electronically to entities seeking a rating through the Ministry’s rating agency. This service is free and takes an average of 30 business days.

Fast Path: This is a paid path that provides electronic credit assessments through the same applications, but at a faster rate. The assessment is completed in approximately 3 business days, based on the entity’s most recent budget.

Integrated Path: A paid service that focuses on a comprehensive assessment of the entity’s current situation, adding business risk criteria, including governance standards, through field visits and interviews with board members, employees, and customers. The final assessment is based on these visits and the opinions of specialists. The process takes an average of 5 business days.

How do I get the best credit rating that reflects the facility’s capabilities?

The best possible credit rating can be achieved through proper planning to obtain a rating certificate. This includes a thorough understanding of all administrative and legal requirements and preparing the company’s file accordingly. In addition, follow these guidelines:

- Read the government’s legal and administrative requirements to understand the requirements for obtaining a rating certificate.

- Prepare a rating file that includes all necessary licenses.

- Review the financial statements, focusing on transparency in the company’s financial figures.

- Analyze the company’s weaknesses and work to close the gaps before applying for the rating certificate.

Or, you can seek the assistance of an accredited consulting firm to properly complete all necessary procedures.

Why do we recommend that companies use Tatweer Alpha Development Company to obtain a classification certificate?

Tatweer Alpha Company is a leading company in issuing classification certificates for all economic establishments in the Kingdom of Saudi Arabia, across various specialties.

Tatweer Alpha Company is distinguished by its preliminary study of the companies to be classified, analyzing their strengths and weaknesses, and providing a comprehensive analysis that includes all the necessary steps. This helps keep decision-makers fully informed of all the procedures that must be followed to improve the establishment’s activity and financial figures, thus achieving the best classification score that reflects the establishment’s correct performance.

High transparency in performance, combined with field experience and extensive relationships, has made Tatweer Alpha Company the first choice for major companies from various sectors in the Kingdom of Saudi Arabia.

You can request a free consultation by contacting the company. Request a free consultation.